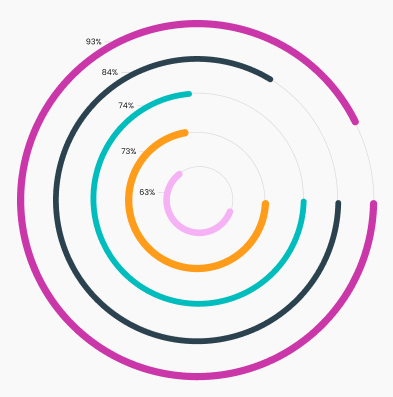

Research

CFO Perspectives on Risk, Growth, and the Future of Finance

Amid continued macroeconomic uncertainty, CFOs across the United States are expressing cautious optimism about their organizations’ financial health and future outlook.

EVENTS

Your Inside Look at What’s Next

Subscribe to Mindshift, RGP’s LinkedIn Newsletter

Tap into bold, visionary insights crafted for leaders like you navigating challenges and turning them into opportunities. Each issue delivers fresh ideas, real-world strategies, and expert perspectives to inspire your next move and architect a brilliant future.