August 11, 2025 • 5 Min Read

After attending the Institute of Management Accountant’s annual conference in Scottsdale, my mind raced as I contemplated the road ahead. The majority of my clients say they will increase AI investments in 2025, yet only about a quarter of them have moved beyond pilot programs. This gap between intention and execution represents the critical inflection point I witnessed first-hand at this year’s conference.

I’ve been consistent in my view that the time for modernizing one’s accounting and finance processes is now, and I’m more convinced than ever that the next 18 months represent an inflection point for organizations to stop talking and start acting.

Three AI Adoption Patterns Emerging in Finance

During the four-day event, I spoke to CFOs, CAOs, directors, managers, and even some students about their challenges and how they’re preparing for the future. The common theme in the responses was “AI” – specifically about how agentic AI was going to transform the Finance & Accounting function. While that theme was virtually universal, the variation among the stories couldn’t have been more significant.

- The Early Adopters: Some talked about how they had implemented AI agents to help with document processing and reconciliations – either through AI embedded in their core application stack or through homegrown implementations.

- The Skeptical Observers: Others were trying to figure out where on the AI hype cycle we are—are we peaking with inflated expectations and how far away can we expect to see real gains? These leaders are caught between FOMO and prudent caution.

- The Paralyzed Majority: Still others were trying to get their organizations to chart a course, fearing they’re not taking advantage of available technology. Our conversations revealed that 60% of finance teams are still manually processing invoices, despite automation tools being readily available.

The Cost of Inaction

A number of people with whom I spoke were extremely frustrated. Some were frustrated because they feel their leadership isn’t investing in the future or even the present. One VP of Finance with whom I spoke expressed frustration with her multi-national firm and their slow acceptance of technology. She vented that they’re wasting valuable time and effort reconciling transactions from bank statements. They are stuck in Excel while forward-thinking firms are using a variety of tools to automate this work.

Organizations delaying AI adoption face mounting costs. Recent research revealed at the IMA Conference indicated that companies slow to adopt automation spend 40% more on routine processing tasks and experience 25% higher staff turnover in finance roles. The business case for action has never been clearer.

The Human Element: Displacement vs. Enhancement

While we take time to envision the benefits we’ll derive from AI as it liberates many of us from routine, repetitive, time-consuming tasks and gives us time to focus on more strategic issues, there’s another side of AI facing the F&A community: displacement and re-skilling.

Some IMA speakers estimated that AI could displace 30% of routine finance tasks by 2030. The question isn’t whether AI will transform finance – it’s whether professionals will lead that transformation or be swept aside by it.

I had a poignant reminder of this when speaking with a mid-level finance manager who, along with several of his peers, was recently asked to join a company call about AI. I think he came to the call excited (“Finally, we’re going to get some tools!”) but the mood shifted pretty quickly. Instead of announcing the toolset the company was going to provide him and his peers, the CFO announced that all of the call’s participants were being dismissed, as their jobs were being “outsourced to AI.”

While I’m certainly sympathetic to his situation (he’s subsequently found employment), I took a moment to discuss my viewpoint. To me, he’s uniquely positioned to flip the script. With ten-plus years of accumulated finance experience, he understands the ins and outs of operational accounting roles, knows the time-sucking repetitive tasks that drive cost and employee dissatisfaction, and has seen where AI is encroaching on the human workforce first-hand.

Rather than being afraid of AI and its impact, I advised him to face his fears head-on: dive into AI, learn about the tools, look for use cases, build consensus—and be the person leading the charge, not someone waiting for the next shoe to drop.

Beyond the Hype: Real ROI from AI Implementation

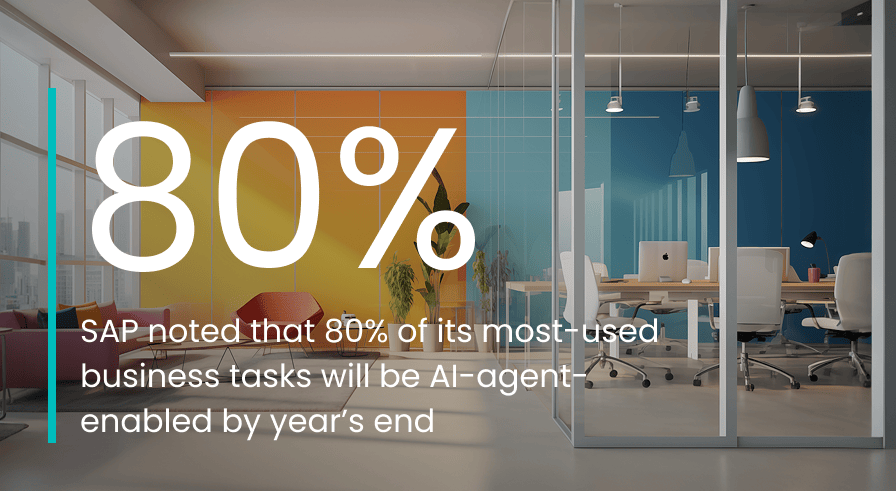

The major ERP platforms are embedding AI into virtually every aspect of their suites – performing reconciliations, variance analyses, and payroll inquiry automation, while enabling users to use natural language to query and interpret data. SAP, who has already announced 40 AI agents, says that 80% of its most-used business tasks will be AI-agent-enabled by year’s end.

Leading financial close platforms such as BlackLine are also bringing AI to F&A, with its Journal Risk Analyzer, advanced matching for inter-company and high-volume transactions, and variance analysis and automation. Accenture research shows AI-enabled finance teams are three times more likely to exceed performance targets.

Beyond embedded AI solutions, I believe that “Bring Your Own AI” or blended solutions (such as customized versions of AI and ML that’s been tuned to specific use cases or datasets) is right around the corner. In fact, they’re already here for many early adopters. As tools are fine-tuned, AP automation is making bold advances, eliminating many of the exceptions, failures, and “kickouts” from last-generation technologies.

The AI Ride: A Lesson in Timing and Readiness

At 4:30am in Scottsdale, I needed a ride to the airport. Waymo’s driverless taxi was available in 5 minutes—half the price of Uber. The future had arrived, I thought. But after a quick shower, the tables turned: Waymo was now 30 minutes away and more expensive, while Uber had a human driver ready in 5.

That driver—a college student studying radiology—shared that AI already helps interpret scans in his field. It struck me: technology can be faster and cheaper but, for the moment, it, like Waymo, isn’t always available. Motivated humans can still fill the gap.

But not for long.

Lead or Be Left Behind

AI is already reshaping industries, including finance. Early adopters are gaining speed and slashing costs. Gartner estimates 80% of finance tasks will involve AI by 2027. CFOs are on alert—two-thirds see AI as essential for staying competitive.

The question isn’t if AI will change your business—it’s when, and whether you’ll be ready. Start building now, or risk competing against those who did.