For our original Human Agility research study, we engaged a select group of business leaders, focusing on the C-suite, and identified the core characteristics that enable organizations to see change as an opportunity rather than an obstacle. In this article we take a deeper look at one of those characteristics, Nimble Finances, with Andy Jones, RGP’s VP, Finance Transformation.

Meeting Finance and Accounting Challenges in the New Normal

When responding to questions about nimble finances during disruptive change, research participants told us the most pressing obstacles they encountered are accelerating shifts in technology, inadequate resources—both human and financial—and, as we’ve seen during the pandemic, transitioning work models.

When responding to questions about nimble finances during disruptive change, research participants told us the most pressing obstacles they encountered are accelerating shifts in technology, inadequate resources—both human and financial—and, as we’ve seen during the pandemic, transitioning work models.

Meanwhile, organizations that embrace agility and adopt more nimble financial practices are better able to overcome those obstacles and realize more benefits, including:

- More adaptive workforce strategies or models

- Adoption of technology that enables businesses to be more successful

- Stronger collaboration tools and capabilities

- Greater operational resilience

These findings validate the perspective Andy Jones shared in the early days of COVID-19. In his article, “Why Now Is the Time for Finance Transformation,” he wrote that companies could hibernate like a bear and just try to survive the winter, or they could reinvent the way they work and emerge transformed, like a butterfly.

In this conversation with Andy, we revisit that prescient advice and explore how finance leaders can take advantage of our Human Agility research to guide their current and future transformation initiatives.

Q. How are the people you’re talking to navigating in this environment? What are they focusing on?

Two years ago, if you had said, “There’s going to be a global pandemic and everybody’s going to work from home for two years or more,” you and I both would have said, “Oh my gosh, get down into the bomb shelter, get down into the bunker.”

What we started to see over the course of the last year is there is a way out of this. But we’re now re-emerging in a new world—we’re starting to see more “butterflies.” I think that clients now are being more aggressive in realizing that they have to change.

Q. What new challenges are finance leaders facing as we begin to emerge from the pandemic?

The war for talent is a challenge for everyone—and it isn’t unique to finance and accounting. Organizations have fewer people on hand to do the work. That’s partly because of what’s being called the “Great Resignation.” Some people left the workplace, or at least left their jobs as they knew them two years ago. And they’ve got new jobs—or they’ve said, “I’m not sure this working thing is right for me right now. So, I’m going to retreat.”

People are realizing that transformation is the vehicle by which you can get more work done with fewer people.

Companies that furloughed people and then tried to hire them back couldn’t—either because they got other jobs or decided not to work. Or companies have come back but don’t have the resources to hire at the levels where they were a couple of years ago. And in either case, that leaves you asking, “How do I get the work done?”

People are realizing that transformation is the vehicle by which you can get that work done, how you get more work done with fewer people. And that can be through optimizing your processes, automating things that can be automated, doing things differently, maybe picking and choosing what work you do.

We can reprioritize as well: What’s important? We’re seeing companies starting to place those bets, saying, “I don’t know everything that’s going to happen in the future. But I know enough to know that it’s a new world out there. And I have to do things differently.”

Capitalizing on Change

When adverse change events occur, you need the financial resilience to place strategic bets and capitalize on emerging opportunities. Not surprisingly, organizations with a healthy resting financial state are better equipped to manage and mitigate risk. Without this ability to take financial risks during macro events, you face another kind of risk: responding to perceived threats by retreating into survival mode.

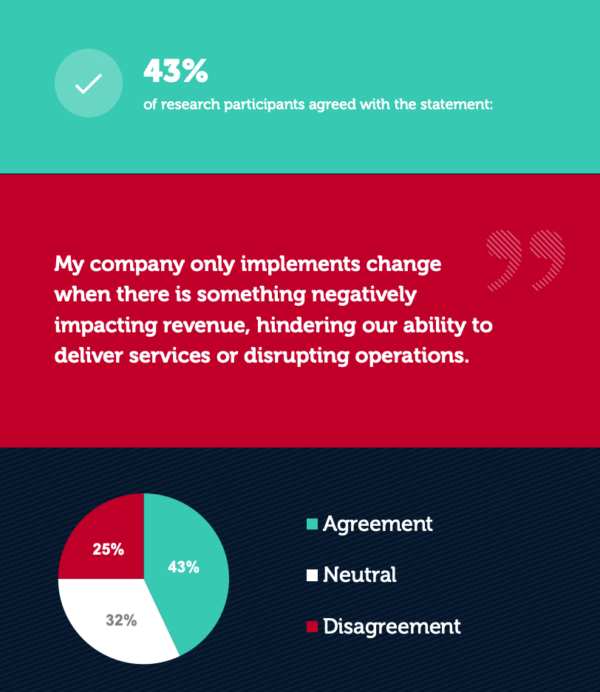

Yet, nearly half of the people who participated in our research said their company only implements change when there’s something negatively impacting revenue or disrupting their core services or operations.

Q. Why would organizations wait to make changes until their bottom line is at risk—isn’t that itself a risky approach?

Q. Why would organizations wait to make changes until their bottom line is at risk—isn’t that itself a risky approach?

In some organizations, it’s all about job preservation—you know, am I going to get fired for making this decision? If so, I’m going to go conservative, because I’ll get fired if I’m wrong.

Sometimes, organizations are forced to innovate because there’s a big change in either the cost structure or the dynamics of the market. Alternatively, truly forward-looking organizations are as likely to say, “Doing things the same way you did last year is not good enough.”

And then, finally, certain companies are at inflection points. One of the exciting groups of clients we’re working with are those companies that are getting ready to go public through an IPO or SPAC. They’ve got to get their ducks in a row—they’ve got to get their controls in place. They need to make sure they please the regulators and potential investors, but they’ve also got to set themselves up for success the year after they’re public. How can they ensure they can scale without a commensurate increase in headcount?

They’re looking for top line growth of 10x or 50x, but they don’t want the workforce to grow that much. That means you have to scale digitally and with agility.

They still need to achieve the same outcomes, but they’re not wed to 100 years’ worth of history in how things have been done in their companies. So, they’re open to a more greenfield approach to how they develop going forward. That could be automation, it could be a wholesale change in how they render services or make and deliver products. Or it could be in the way they look at finance and back-office functions.

Today’s level of business may be fine, but investors are betting on where they’ll be three years from now. They’re asking, “How can I scale?” And the answer isn’t by doing things the way they’re doing them today. That just gets you to break-even. That’s not what the investor community is paying for. They’re looking for top-line growth of 10x or 50x, but they don’t want the workforce to grow that much.

That means you have to scale digitally and with agility. And you do that by transforming to make processes more efficient and using automation where possible.

Whatever challenges you face, our Finance Transformation team can help you assess your current situation and design a roadmap that will enable you to overcome obstacles with greater agility and realize the benefits of change to innovate for the future.